Finance

This programme equips future financial experts with skills that will respond to technological changes and global market trends.

Get to know the study programme

Program structure

What will I learn?

What will I learn?

What will I learn?

What will I learn?

What will I learn?

What will I learn?

What will I learn?

What can I be?

Financial Analyst

Stockbroker

Investment fund manager

Tax consultant

Financial advisor

Auditor

Founder of a fintech startup

Programme benefits

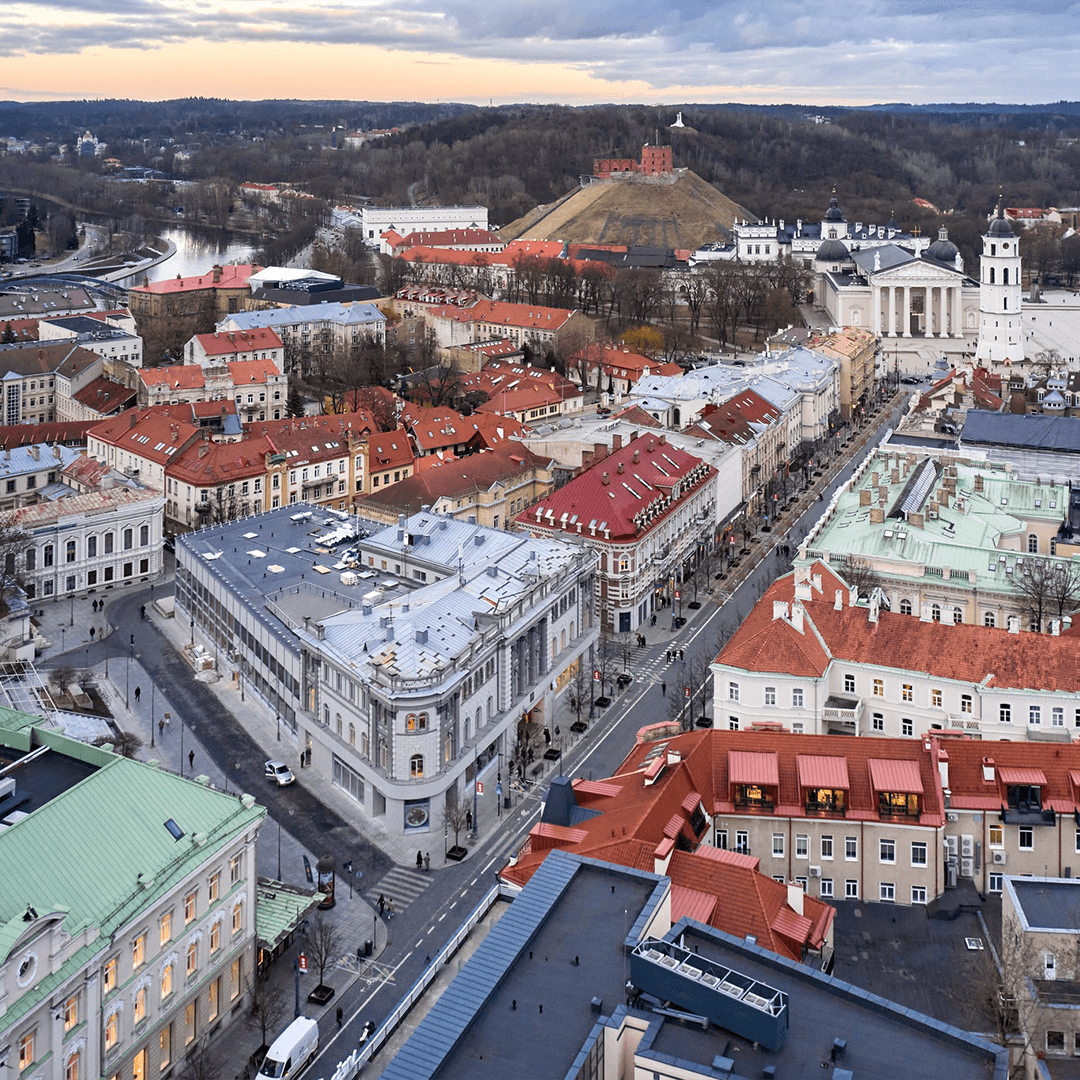

Opportunities abroad

Double degree with BI Norwegian Business School

Study in Norway, in one of the world’s 1 percent of Triple Crown-accredited universities (AMBA, EQUIS, AACSB).How does this work? Selection takes place in the fourth semester of studies. Students who pass the selection will study at BI Norwegian Business School for one year.

How much does it cost? Tuition fees are payable at BI Norwegian Business School. A ten percent discount applies. Meanwhile the student is required to pay for the studies at the ISM University.

Where will I live while studying in Norway? BI Norwegian Business School offers various types of accommodation in student residences.

How will I benefit from this program? You will receive diplomas from two high schools almost at the same time. You will form an international circle of acquaintances. While studying abroad, you will broaden your horizons and be able to feel comfortable and work efficiently in a multicultural environment.

100+ university exchange partners worldwide

One third of which have at least one prestigious business university accreditation (AACSB, EQUIS, AMBA).How does this work? Each semester you can choose a university that is an ISM partner and participates in the selection. After successfully completing the selection, proceed to the exchange program next semester.

How much does it cost? No extra fees apply. You will pay the usual tuition fee.

How long does it take? The exchange semester lasts about 5 months

What do I have to do to participate in the exchange program? You have to pass the exams – you are permitted to fail only one exam.

News and events

The programme introduced me to not only a broader look at the economy, financial markets, investments, and personal finance but also helped to get a job faster.

Studies at ISM – accessible to everyone

Price

Investing in studies pays off

Considering studies at ISM?